As digital banking and mobile apps become more common, scammers are using increasingly sophisticated methods to steal sensitive information. A rising threat involves exploiting screen sharing during phone calls, where fraudsters pose as banks or trusted institutions to trick users into revealing passwords, account details, or authorising unauthorised transactions. To tackle this issue, Android has launched a pilot programme in the United States, designed to protect users from such scams. The feature automatically detects when a call from an unknown number coincides with screen sharing on a banking app, issuing a prominent warning and providing an option to end the call immediately. This approach helps disrupt social engineering tactics, giving users time to reconsider actions and prevent financial loss.

Screen sharing scams : How fraudsters exploit mobile users and banking apps

Screen sharing scams represent a new level of cybercrime that targets mobile users through social engineering. Fraudsters often pose as representatives of banks, payment platforms, or other trusted institutions. The typical scam scenario includes:

- Receiving a call from someone claiming to be from a bank or fintech company.

- Being asked to share your device screen to “verify information” or “assist with a transaction”.

- Manipulating the user into revealing sensitive data, such as account numbers, passwords, or one-time codes.

The danger lies in the psychological tactics used. Scammers create urgency and pressure, making victims feel they must act immediately to prevent financial loss. This combination of fear and authority makes screen-sharing scams particularly effective.

Android screen sharing protection: Safeguarding users from call scams

Android devices running version 11 and above now include a proactive safety feature that targets these risky scenarios. The system monitors for situations where a user is:

- On a call from an unknown number.

- Using screen sharing while accessing financial or banking apps.

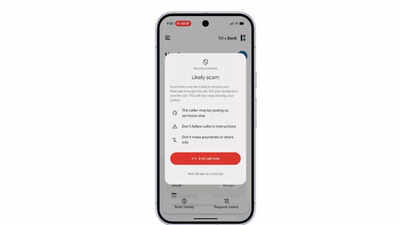

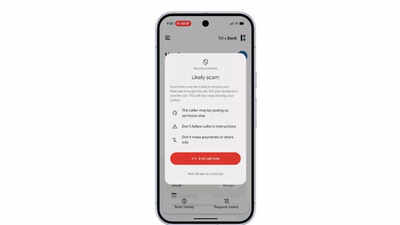

When both conditions are met, Android automatically displays a large, on-screen warning. This warning:

- Alerts the user that the caller may not be who they claim to be.

- Advises against following instructions or sharing personal and financial information.

- Provides a prominent red “End call now” button that instantly terminates both the call and the screen sharing session.

This immediate intervention helps prevent potential fraud before the scammer can gain access to sensitive information.

30-second pause feature : Protecting users from call-based scams

A unique aspect of this protection is the 30-second pause introduced before users can continue interacting with the call. This pause serves several important purposes:

- Disrupts urgency tactics: Scammers often pressure users to act quickly. The delay breaks this psychological manipulation.

- Allows time for reflection: Users can pause and reconsider their next steps, reducing the likelihood of making impulsive decisions.

- Improves decision-making: By slowing down the interaction, the user can better assess whether the call is legitimate or a scam attempt.

This combination of warning and delay is designed to neutralise the social engineering strategies that scammers rely on.

From UK testing to US rollout: Strengthening call and screen sharing safety

Before launching in the US, Google tested the feature in the United Kingdom earlier in 2025. Results showed that:

- Thousands of users successfully ended risky calls.

- Many potential financial losses were prevented.

- Feedback helped refine the feature for wider deployment.

The UK pilot demonstrated that simple interventions, such as warnings and a call-ending button, can have a major impact on user safety.Android’s scam protection is now being piloted in the United States, with support from several major financial services providers. This includes:

- Popular fintech apps, such as Cash App.

- Leading banks, including JPMorgan Chase.

Integration with these apps ensures the feature functions effectively, providing real-time protection for users who interact with banking services on their phones.

Why in-call scam protection is essential

As scammers employ more advanced tactics, traditional security measures are no longer sufficient. Android’s in-call protection addresses the problem by:

- Providing immediate warnings for suspicious calls.

- Allowing users to end calls and stop screen sharing quickly.

- Introducing a 30-second pause to prevent impulsive decisions.

By combining these three elements, Android makes it significantly harder for fraudsters to manipulate users into revealing sensitive information.