In the early 2000s, American factory towns began to empty out. In North Carolina, furniture makers who had worked three generations watched their mills close. Across the industrial centres– from Jakarta to Ohio, a quiet devastation spread—not from war or natural disaster, but from an economic force few had anticipated.In the spring of 2001, when China joined the World Trade Organization, few anticipated the seismic transformation that would follow. Over the next decade, a torrent of Chinese exports swept through global markets with such force that economists gave it a name: the China Shock. By the time the dust settled, an estimated 2.0 to 2.4 million American manufacturing jobs had vanished, wages in affected communities remained depressed for a full decade, and the political landscape of the industrialized world had been permanently altered.Now, twenty-four years later, the tremors have returned—but this time, they emanate not from factories churning out toys and textiles, but from gleaming facilities producing electric vehicles, lithium-ion batteries, solar panels, and semiconductors. Welcome to China Shock 2.0: a techno-industrial upheaval that threatens to be both broader in scope and deeper in consequence than its predecessor.

The anatomy of two shocks: What’s different now?

To understand the magnitude of what’s emerging, we must first distinguish between the two shocks clearly. The foundational research on the first China Shock comes from economists David Autor of MIT, David Dorn of the University of Zurich, and Gordon Hanson of Harvard. Their landmark 2013 paper in the American Economic Review documented how rising Chinese imports between 1990 and 2007 devastated local labor markets across the United States. The findings challenged orthodox economic thinking that assumed workers displaced by trade would smoothly transition to new jobs and industries.The researchers found that import competition explained approximately one-quarter of the aggregate decline in US manufacturing employment during this period. More troubling still, their follow-up work demonstrated that adjustment in affected communities was “remarkably slow”—wages, labor-force participation rates, and unemployment remained depressed for at least a full decade after the shock commenced. Now, Autor warns of something far more serious. “The US is in danger of losing the next great manufacturing battle, this time over advanced technologies to make cars and planes as well as those enabling AI, quantum computing, and fusion energy”, he told MIT Technology Review in July.The second is powered by technological leadership, industrial policy of unprecedented scope, and dominance across entire value chains. According to the Centre for Economic Policy Research (CEPR), China is now “the world’s sole manufacturing superpower”—a status reflected in hard data that would have seemed fantastical two decades ago.In 2024, China accounted for approximately 27.7% of global manufacturing output by value, producing $4.66 trillion worth of manufactured goods according to World Bank data compiled through the United Nations Statistics Division. By volume metrics, China’s share rises even higher—some estimates place it at 35% of global gross manufacturing production, more than the combined output of the United States, Japan, Germany, and India. China’s dominance in strategic sectors:

- 85-90% of global solar module production

- 60% of electric vehicle battery manufacturing

- 70% of lithium processing capacity

- 70% of the civilian drone market

- 80% of rare earth element refining

“China has this immense manufacturing capacity, and the goods have to go somewhere” Gordon Hanson, now a professor at Harvard Kennedy School, said earlier this year.The competition between Washington and Beijing has fundamentally shifted terrain. Where once the contest centered on textile quotas and steel dumping, today it revolves around semiconductor fabrication, artificial intelligence computing power, and electric vehicle supply chains.China leads in 57 of 64 critical technologies tracked by the Australian Strategic Policy Institute, compared to leading in only three technologies two decades ago. These aren’t peripheral capabilities—they include advanced aircraft engines, quantum computing, high-performance computing, and military-linked technologies like autonomous systems and radar with focus on innovation.

The industrial policy arms race

The asymmetry in government support is staggering. China spends an estimated $450-500 billion annually on industrial subsidies—a figure confirmed by research from the Kiel Institute for the World Economy and Rhodium Group.By contrast, the US CHIPS Act allocates $52 billion over five years. The European Union’s Chips Act commits €43 billion. India’s Production Linked Incentive schemes total $26 billion. Japan and South Korea have announced roughly $50 billion combined in semiconductor and battery support. Together, these efforts amount to approximately $100 billion per year—one-fifth of China’s commitment.The US-China Economic and Security Review Commission’s 2025 annual report says “China Shock 2.0 also threatens to complicate de-risking efforts, as China’s market share gained from export dominance can be quickly turned into leverage over the supply chain.”The report notes that China has begun producing higher-value-added goods at scale, the result of years of technology acquisition, massive government subsidies, and aggressive industrial policies.

China Shock 2.0 may result in Chinese producers taking over market share in countries all over the world.

US-China Economic and Security Review Commission’s 2025 Report

Yet Goldman Sachs Research remains bullish on China’s trajectory. The investment bank raised its real GDP forecast for 2026 from 4.3% to 4.8% and for 2027 from 4.0% to 4.7%, citing the government’s determination to advance manufacturing competitiveness and boost exports.“The approval of the new Five-Year Plan proposal highlights the government’s determination and capability to keep advancing its manufacturing and boost its export market share”, Goldman Sachs noted in its November analysis.Hui Shan, Goldman Sachs’ chief China economist, explained the resilience: “Chinese exports of chips, semiconductors, autos, auto parts—they are growing steadily despite the fact that the US has imposed tariffs”.

The Trillion-dollar surplus: China’s trade position

In 2024, China recorded the largest global trade surplus in economic history: $992 billion, according to official customs data. This figure beat the previous record of $838 billion set in 2022 and approached the symbolically potent $1 trillion mark.The IMF has documented how China’s trade surplus rose substantially following the pandemic, driven by weak domestic demand from a property market downturn and elevated household savings rates. According to a September 2024 IMF analysis, China’s trade balance stood between 2% and 4% of GDP. IMF data shows China’s export volumes rose approximately 40% between 2019 and 2024, while import volumes increased by only 1%.

State support: China’s industrial subsidies

A central point of contention in the China Shock 2.0 debate concerns the role of state subsidies. Multiple organizations have attempted to quantify the scale of Chinese industrial policy support, with estimates varying significantly.The OECD’s Manufacturing Groups and Industrial Corporations (MAGIC) database found that Chinese firms receive “four to eight times” the subsidy rates of other firms. A recent IMF working paper estimated that the equivalent fiscal cost of Chinese industrial policy is approximately 4% of GDP per year.

India at the crossroads

For India, the moment represents both peril and extraordinary opportunity.With 67 million manufacturing workers, a growing working-age population, and democratic governance, India could emerge as the critical counterweight to Chinese manufacturing dominance. “India must push manufacturing to grow employment and develop a stronger economy,” Kant said.” said Former Niti aayog CEO Amitabh Kant, India’s G20 Sherpa. In September 2025. David Autor emphasized the stakes in his July interview: “When we think about advanced manufacturing and why it’s important, it’s not so much about the number of jobs anymore. It’s about economic leadership. It’s about innovation. It’s about political leadership, and even standard setting for how the rest of the world works”.The government’s Production Linked Incentive schemes have shown promise. Electronics manufacturing has grown rapidly, with exports reaching $42 billion in 2024. But the scale remains insufficient.Yet India possesses unique advantages. Its demographic dividend is just beginning–the working-age population will continue growing even as China shrinks. The country has demonstrated capabilities in pharmaceuticals, IT services, and automotive manufacturing. Democratic governance provides political stability that reassures Western partners seeking to diversify supply chains.

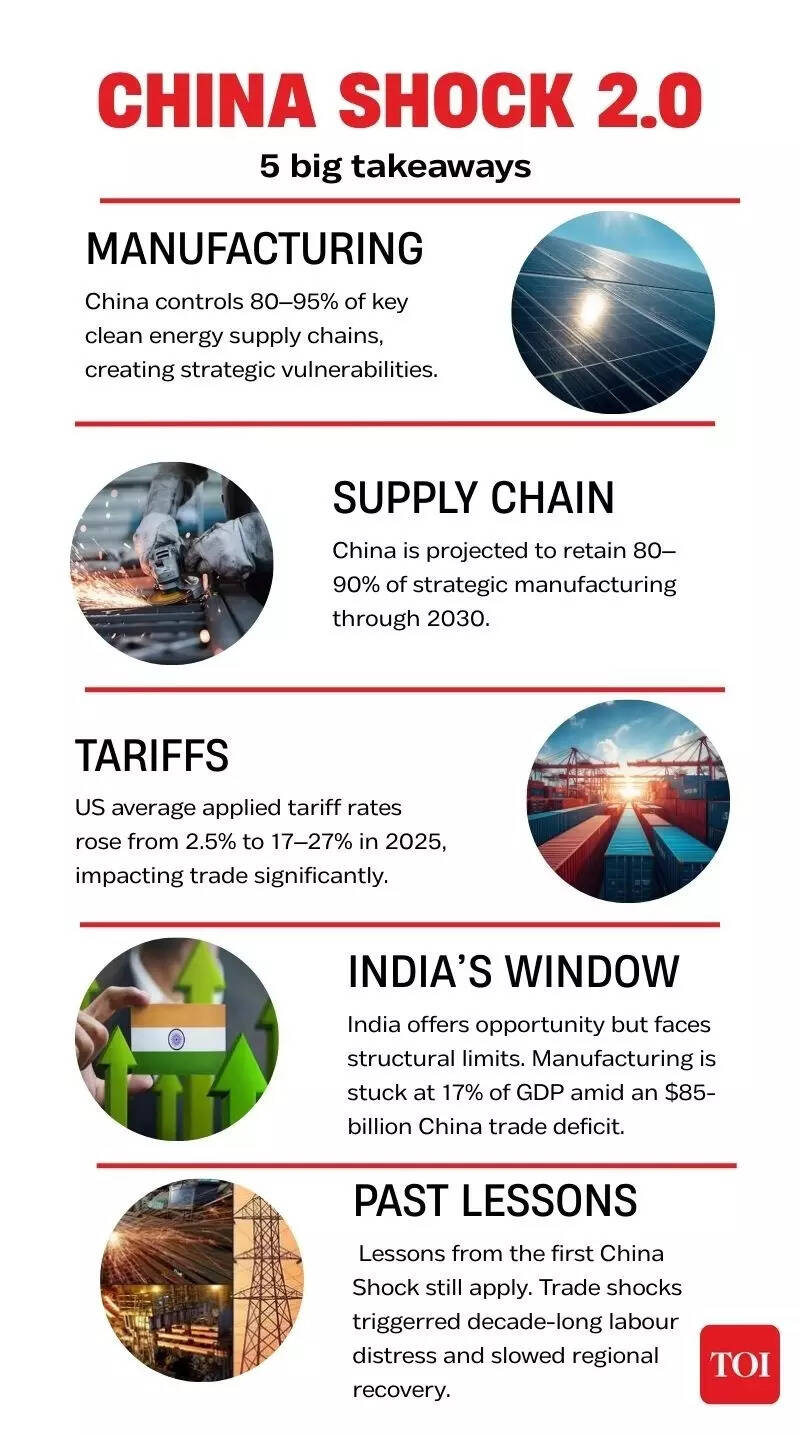

Key takeaways -China Shock 2.0

The fundamental question is not whether China Shock 2.0 occurs– but whether countries can coordinate an effective response at sufficient scale before Chinese dominance becomes irreversible.The clock is ticking.As the US-China Economic and Security Review Commission’s 2025 Report makes clear:“In many ways, China Shock 2.0 is enabled by the limitations of that system—many countries are constrained in how they can respond to the deluge of China’s excess production despite the growing threat of damage to their labor markets and home industries.” The fundamental question facing policymakers in Washington, Brussels, Tokyo, Seoul, and New Delhi is not whether China Shock 2.0 is coming, but the only question is whether we are ready this time.For millions of workers in automotive plants, battery factories, solar installations, and electronics assembly, the answer will determine not just abstract national competitiveness, but the concrete reality of whether their jobs, communities, and livelihoods can survive the second great wave from the East.