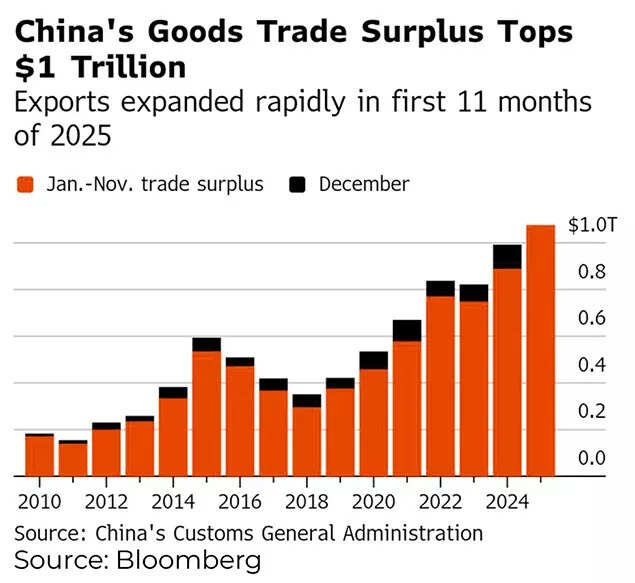

Driving the news:Despite nearly a decade of US tariffs under President Donald Trump, China’s trade surplus has exploded, hitting $1.08 trillion through November – the highest ever recorded globally and a level China didn’t reach until year-end just last year.The record, announced by China’s customs agency this week, represents a 21.7% increase over the same period in 2024 and underscores China’s rising dominance in global exports. “They should not be surprised that China is able to find markets outside of the advanced economies,” Mary Lovely, senior fellow at the Peterson Institute for International Economics, told the New York Times.

China’s Goods Trade Surplus Tops $1 Trillion

Why it mattersPresident Trump’s trade war strategy – featuring sweeping tariffs, tough rhetoric, and promises to rebuild US manufacturing – has not curtailed China’s export machine.Instead, China has restructured, rerouted, and retooled, pushing more goods into emerging markets, Europe, and Southeast Asia – often by moving final assembly outside its borders to dodge tariff barriers. “Despite persistent trade tensions… we believe China will gain more share in the global goods export market,” said Morgan Stanley’s Chetan Ahya.This surge positions China not only as the world’s dominant supplier of goods but also as a geopolitical force, leveraging exports to build ties – and dependencies – across the Global South.Zoom inHere’s how China’s $1.08 trillion trade surplus was built:Diversified markets

- Exports to Africa rose 42%, to Europe 15%, and to Latin America by double digits.

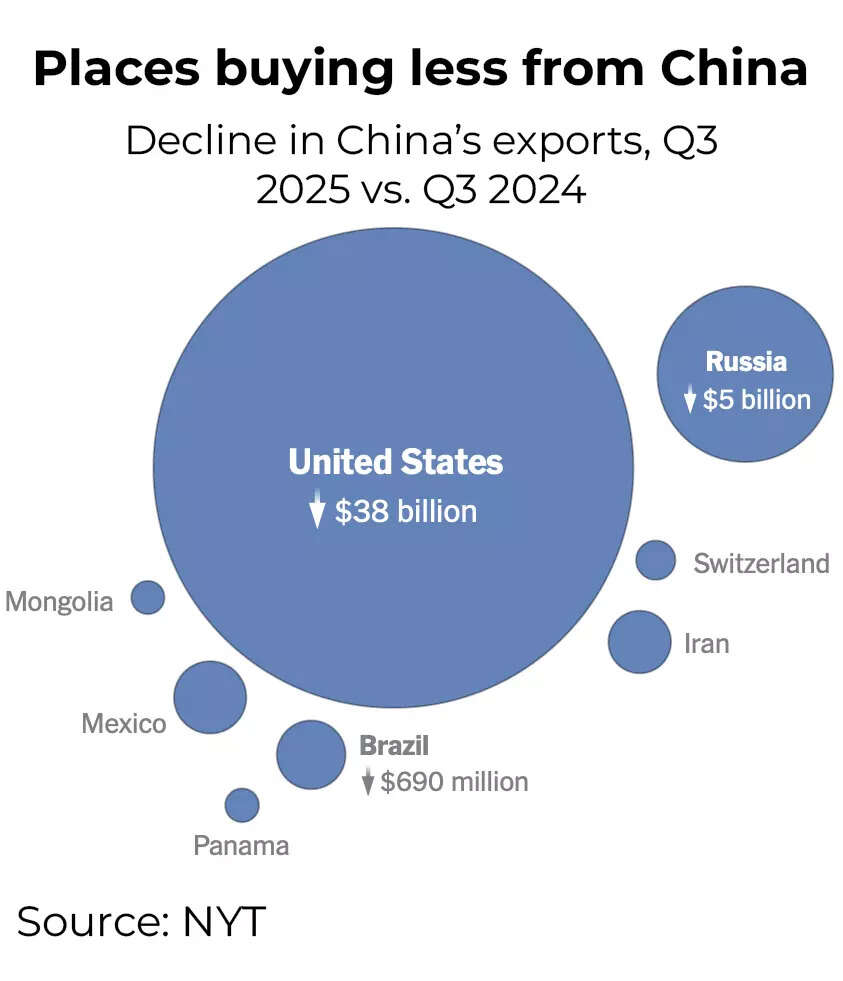

- US-bound shipments fell 29% year-over-year in November, marking the eighth straight month of double-digit declines.

- But sales to France, Germany and Italy boomed – all reporting double-digit growth.

Places buying more from China

Manufacturing shifts:* Chinese companies moved parts of their supply chain to Southeast Asia, Mexico, and Africa, which then export to the US – effectively bypassing Trump-era tariffs.* These “trans-shipping” tactics allowed Chinese firms to continue supplying American retailers while masking origin.

Places buying less from China

Currency advantage

- The renminbi has weakened significantly, particularly against the euro, making Chinese goods even cheaper abroad.

- Prices in China are falling, while those in the US and Europe are rising – supercharging competitiveness.

“With the renminbi undervalued by 30% against the euro… it will be exceedingly difficult… to compete against Chinese manufacturers,” said Jens Eskelund, president of the EU Chamber of Commerce in China .Between the linesTrump’s tariffs, once seen as a bold bid to reshore jobs and production, have created only limited disruption to China’s trajectory.

- Exports of toys, electronics, and plastic goods to the US are down, but the loss has been overcompensated by booming sales elsewhere.

- China is intentionally selling at low margins to emerging markets to gain long-term geopolitical and economic influence.

“The margins may not be as high,” Ilaria Mazzocco of the Center for Strategic and International Studies told the NYT. “But for those markets, it’s entirely transformational”.Meanwhile, US importers are increasingly turning to India, Vietnam, and Taiwan – but many of those supply chains still begin in China.The big picturePresident Trump’s trade war was meant to reduce America’s reliance on Chinese goods and give US factories a competitive edge.But instead, China has shown it can reorient its export model, reclaim global market share, and sidestep tariff pressure – faster than Washington anticipated.

- China is now the world’s largest producer of electric vehicles, batteries, solar panels, and consumer electronics.

- In many African countries, Chinese vehicles and tech – once nearly absent – now dominate markets.

- Sales of Chinese-made EVs and solar panels to Nigeria and Algeria have multiplied, disrupting local industries.

This transformation was no accident. It’s the result of years of top-down industrial planning from Beijing – and decades of underinvestment in manufacturing capacity across the West.

China’s exports rebound in November

“China’s trade surplus in factory goods is even bigger… than the US after World War II,” notes the New York Times.The Trump factorEven as President Trump agreed to a one-year trade truce with Xi Jinping in October, his administration continues to weigh additional tariffs, particularly on industries like pharmaceuticals and drones, where China dominates.And while he reduced some tariffs, they still hover at 45% – historically high levels.But critics argue that Trump’s trade war mostly reconfigured supply chains, rather than revitalizing American industry.What they’re saying“November’s stronger-than-expected export growth demonstrates the resilience and competitiveness of China’s exporters,” said David Qu, chief China economist at Bloomberg Economics.“The rebound of export growth in November helps to mitigate the weak domestic demand,” added Zhiwei Zhang of Pinpoint Asset Management.But while exports are thriving, consumer spending at home remains weak, and factory activity has now contracted for eight straight months, raising concerns about the sustainability of export-led growth.What’s nextThe International Monetary Fund is in China this week to assess its currency practices, including whether the renminbi is being kept artificially low to boost exports. A preliminary report is expected Wednesday.At the same time, calls are growing inside China to allow the currency to appreciate – a move that would:

- Make foreign imports cheaper

- Increase household purchasing power

- But hurt exporters by reducing the value of foreign earnings

“To expand domestic demand, it is necessary to minimize the trade surplus,” said Zhang Jun of Fudan University .What to watch:Global pushback: As China’s exports flood markets, the EU is considering new anti-dumping measures. Other regions – including India and Brazil – are exploring safeguard tariffs.Slowdown risk: Despite strong export performance, China’s economy is losing momentum heading into 2026, and export growth may not be enough to offset weak domestic demand.Policy pivot: At a recent Politburo meeting, President Xi emphasized domestic demand as China’s top priority for 2026, signaling a longer-term effort to rebalance the economy away from exports .The bottom line:Trump’s tariffs were loud, but China’s strategy was louder.Through currency policy, transshipment, and industrial strength, China has not only survived the trade war – it has thrived, with a record-smashing $1.08 trillion trade surplus to show for it.If the US wants to challenge China’s dominance, it may need more than tariffs. It will require reinvestment, innovation, and allies – and a serious reevaluation of what a “win” in global trade even looks like.(With inputs from agencies)