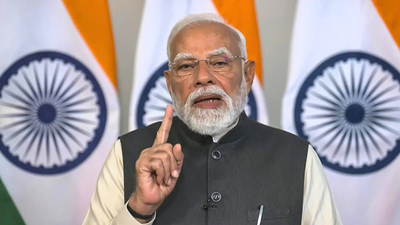

For many students coming back to India after an international degree, the mental checklist is familiar: job interviews, loan repayments, course equivalence, and the awkward joy of living with family again. Taxes don’t usually make that list. But Union Budget 2026 has introduced a clause that returning students should read carefully because it deals with something most students accidentally end up with abroad: Foreign income trails and foreign financial accounts.In Union Budget 2026, Finance Minister Nirmala Sitharaman announced a one-time, six-month foreign asset disclosure scheme for taxpayers who have previously undisclosed overseas income or foreign assets, provided these fall below specified monetary limits—up to ₹1 crore or ₹5 crore, depending on the category notified. Those who disclose within this window will get immunity from prosecution and penalties. In simple terms, it is a time-limited “clean-up” opportunity to declare eligible overseas income or assets without facing legal action.

Why students are part of this often without realising it

Students who study abroad create financial footprints by default. Many open a foreign bank account in the country of study to pay rent, receive scholarships or stipends, and manage day-to-day expenses. Some take up paid internships, work part-time on campus, or earn through short research roles. Others receive stock-linked compensation—such as Employee Stock Options (ESOPs) or Restricted Stock Units (RSUs)—during internships or entry-level jobs with global firms.None of this feels like “wealth”. But when you return to India and become a resident for tax purposes (meaning India treats you as taxable on your global income under certain conditions), some of these overseas accounts or earnings may need to be disclosed in your Indian tax filings. Many students miss this because tax rules around foreign disclosures are not taught, rarely explained at departure, and easy to misunderstand on return.

Who should pay attention

This new clause announced by the Finance Minister Union Budget 2026 matters if you:

- studied abroad and have recently returned to India

- held a foreign bank account during your course

- received stipends, fellowships, or assistantship payments

- earned through internships, campus jobs, or overseas contracts

- were granted stock options or shares by a foreign employer

- are unsure when your tax residency status changed

In short, if education took you across borders and money followed—even briefly—this is not someone else’s problem.

What the Union Budget 2026 clause does and does not do

In Union Budget 2026, Sitharaman has positioned the six-month foreign asset disclosure window as a compliance reset. It allows eligible individuals to voluntarily declare previously undisclosed foreign income or foreign assets within the notified limits and, if they qualify, do so without facing penalties or prosecution. For returning students and early-career professionals, this creates a rare opportunity to regularise past omissions before careers, incomes, and regulatory scrutiny grow.However, this scheme is not a blanket amnesty. It is time-bound, available only once, and restricted to disclosures below specified asset-value thresholds. Once the six-month window closes, normal enforcement provisions will apply again. The policy signal is unambiguous: this is a one-time chance to clean up—future leniency should not be assumed.

The larger signal

India now sends more students abroad than ever before. Global degrees, cross-border research, and international work experience have become mainstream, not exceptional. Tax systems, however, were built for a less mobile generation. This clause of Union Budget 2026 tacitly acknowledges that gap. It recognises that many young Indians are technically non-compliant not because they hid wealth, but because global education outpaced tax literacy.

Bottom line

If you have studied abroad and are filing taxes in India, don’t assume small amounts are invisible or irrelevant. Union Budget 2026 offers a narrow, one-time window to fix innocent oversights without consequences. Ignoring it may feel easier today—but could become far more expensive tomorrow.