At eleven sharp on Sunday morning, as much of India is still negotiating between chai and filter coffee, finance minister Nirmala Sitharaman will rise in Parliament and begin reading a document that pretends to be about numbers but is really about intent.Budgets in India are rarely about surprise anymore. They are about reassurance, about telling markets that the government knows its math, telling voters that restraint has a purpose and telling bond traders that no one is planning to let go of the wheel.This year’s Union Budget arrives with an unusual alignment of calendar and context. February 1 falls on a Sunday. Markets will open for a special trading session. Television studios are already warming up their graphics. Somewhere between North Block and Dalal Street, the Budget has once again become appointment viewing. But once the theatre fades, what remains is a distinctly sober fiscal script.

Consolidation without contrition

If one word defines the build up to Budget 2026, it is continuity.The Economic Survey has already set the tone. Growth remains healthy, inflation is expected to stay muted in the medium term, and macro fundamentals are described as strong, even resilient. That backdrop allows the Budget to focus less on firefighting and more on sequencing.Most projections converge on a gross fiscal deficit of around 4.3 per cent of GDP for FY27, a marginal step down from the 4.4 per cent estimated for FY26. It is not designed to impress but to reassure.

More telling than the headline number is the quiet shift in emphasis underneath it. The Economic Survey repeatedly nudges attention away from annual deficit optics toward debt to GDP as the more meaningful fiscal anchor. That aligns India with global fiscal thinking and signals that credibility will be built across cycles, not speeches.The medium term ambition doing the rounds in policy circles is to bring debt to GDP down from the mid 50s today toward the low 50s by the end of the decade. Whether that target appears explicitly in the speech or remains implied will be one of the subtler cues to watch.

No giveaways, no gasps

This is not expected to be a Budget of populist generosity. There are no serious expectations of sweeping tax cuts or dramatic rewrites of the tax code. That restraint is deliberate.The Economic Survey itself warns that in a world of volatile capital flows and heavy bond supply, fiscal credibility has become a strategic asset. Every rupee of largesse today echoes as borrowing tomorrow, and echoes travel fast in bond markets.Instead, expect incrementalism, targeted tweaks, administrative rationalisation and compliance nudges; enough to keep constituencies engaged but not enough to disturb the arithmetic.For taxpayers hoping for spectacle, Sunday may feel underwhelming. For fiscal hawks, it should read ‘discipline’.

The assumption beneath the math

Every Budget stands on a few assumptions that make the numbers add up. This one leans on nominal GDP growth of a little over 10 per cent.That assumption is consistent with the Economic Survey’s assessment of India’s upgraded potential growth of around 7 per cent in real terms and subdued inflation pressures. It provides room to reduce deficits while continuing to spend meaningfully on growth supporting areas.But it also leaves little margin for error. Any global shock, commodity spike or growth disappointment would tighten choices quickly. Confidence in growth, here, is not rhetoric. It is fiscal scaffolding.

Capex , sharpened

If there is one message the government has repeated often enough to believe, it is that capital expenditure remains non negotiable.For FY27, central capex is expected at around ₹12.4 trillion, growing at a little over 10 per cent and holding close to 3 per cent of GDP. That number matters but where the money flows matters more. This year, the emphasis is expected to tilt more decisively toward defence and strategic manufacturing, with defence outlays projected to rise meaningfully over FY26 levels. This dovetails neatly with the Economic Survey’s larger argument on strategic resilience and indispensability.Infrastructure linked manufacturing, electronics, power, logistics and critical minerals follow close behind. This is capex with a geopolitical subtext, not just a Keynesian one.

Revenue discipline by design

On the other side of the ledger, revenue expenditure is expected to remain tightly controlled. Subsidies are not disappearing, but they are being contained. Food and fertiliser remain the largest components but there is little appetite for expanding discretionary spending. The message is clear: spend but do not sprawl.That restraint also reflects a recognition highlighted in the Economic Survey that state level fiscal behaviour increasingly affects sovereign borrowing costs. Discipline is no longer a local virtue.

Dividends doing the quiet work

If capex is the headline act, non-tax revenues are the quiet stabiliser. RBI dividends and PSU payouts are expected to remain an important fiscal cushion. Together, they help support the math without new taxes or additional borrowing. The Economic Survey notes, implicitly, that strong institutional balance sheets have become part of India’s fiscal buffer.

Taxes: steady, not spectacular

Direct tax collections are expected to grow in low double digits, reflecting compliance gains rather than policy shocks. GST growth, by contrast, is expected to remain moderate, underlining the limits of indirect tax buoyancy in the current cycle. There is no crisis here , just realism.Borrowing and the bond market’s verdictThis is where the Budget meets its toughest audience. Gross market borrowing for FY27 is expected to remain heavy, and when combined with state borrowing, total supply remains substantial. The implication is straightforward. Bond yields are unlikely to fall dramatically, regardless of how elegant the fiscal math appears.The Economic Survey itself is candid on this point. In a savings deficient economy running a current account deficit, capital remains structurally expensive. Arithmetic can reassure, but it cannot suspend gravity.

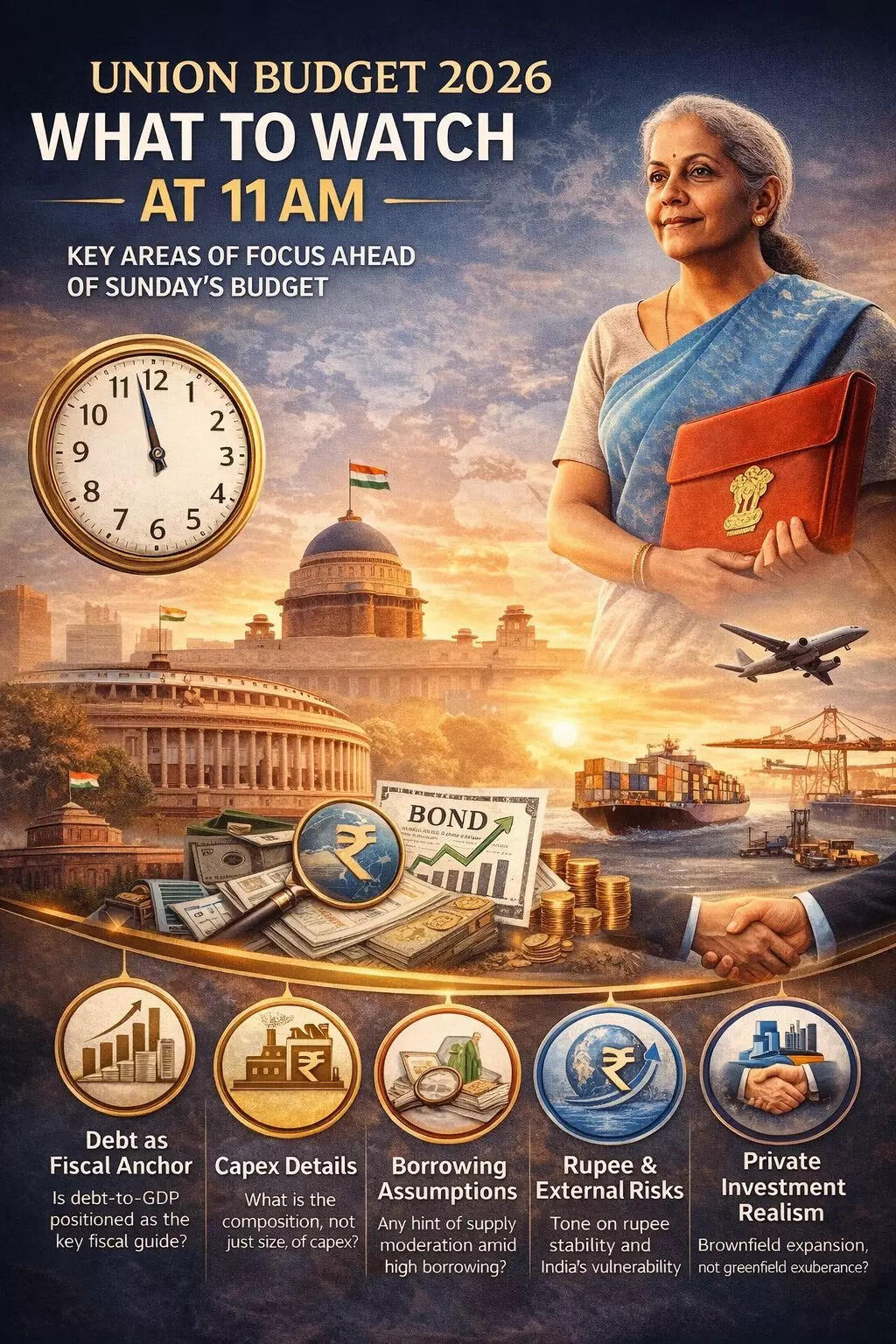

What to watch at 11 am

As the speech unfolds, a few signals will matter more than applause lines:

- How clearly debt to GDP is positioned as the fiscal anchor

- The composition, not just the size, of capex

- Borrowing assumptions and any hint of supply moderation

- Tone on the rupee and external vulnerability

- Realism around private investment, likely driven by brownfield expansion rather than greenfield exuberance

The ending that counts

Budgets are often judged by what they give. This one may be judged by what it refuses to promise. No fiscal bravado,no attempt to charm markets with optimism unmoored from arithmetic.Instead, Budget 2026 appears set to speak softly, signal continuity and let credibility do the work. When the speech ends, the real verdict will come not from studio panels but quietly from the yield curve. In an extremely uncertain global environment that calm response may be the strongest endorsement this Budget can hope for.