The Budget for FY 2026-27 is a mix of cautious and reform- oriented measures for stock market investors. The government proposed tougher norms for trading in futures and options, along with new opportunities for foreign Indian investors.During her speech, Finance Minister Nirmala Sitharaman announced an increase in the Securities Transaction Tax (STT) on Futures and Options (F&O), a change in the taxation regime for share buybacks, and improved access for non-resident Indians to equities.

STT hike to cool F&O frenzy

In a move aimed at discouraging excessive speculation in derivatives, the government has proposed a steep increase in Securities Transaction Tax on futures and options trades.The STT on futures will rise to 0.05 per cent from 0.02 per cent, while the tax on options premium and exercise of options will both increase to 0.15 per cent. Currently, these stand at 0.1 per cent and 0.125 per cent, respectively.Market participants say the higher transaction costs could dampen trading volumes, particularly among retail traders, arbitrageurs and short-term participants. The move comes amid regulatory concerns that a large majority of individual traders in the F&O segment continue to incur losses. Policymakers appear to be prioritising moderation in derivatives activity over revenue gains, especially as higher taxes may themselves reduce volumes.“The measured increase in STT on futures and options reflects a clear intent to curb excessive speculation, fostering a more stable market and encouraging sustainable participation from long-term retail and institutional investors,” Vishal Kampani, vice chairman and managing director at JM Financial Ltd, told TOI.Meanwhile, talking about retail investors’ perspective, Archit Gupta, Founder and CEO, ClearTax told TOI, “The Budget’s hike in STT, by 150% on Futures and 50% on Options, sends a clear signal: the government wants to slow down excessive short-term trading. Even though STT collections stayed flat at around Rs 45,000 crore (from FY2425 to FY2625) against a Rs 78,000 crore target, the bigger story lies in the investor behaviour. Retail participation hasn’t fallen; it has evolved. With over 21 crore demat accounts and record SIP inflows of Rs 31,000 crore+ in 2025, we’re seeing a shift from frequent trading to long-term investing. The policy choice is clear – support steady capital formation over short-term transaction revenue.”

Buyback tax overhaul: What it means

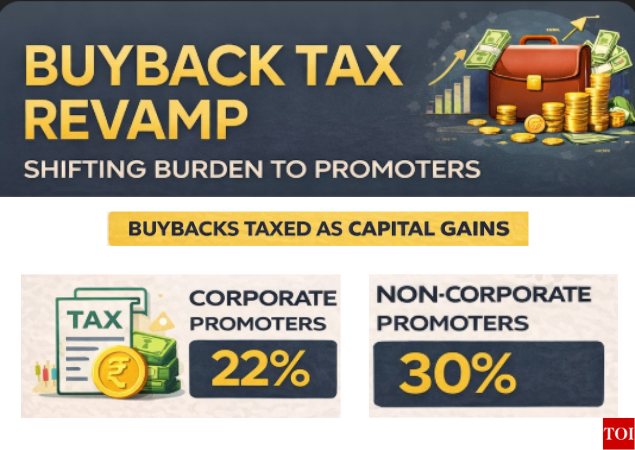

The Budget also overhauled the taxation on share buybacks in a move said to be aimed at protecting minority shareholders and curb tax arbitrage by promoters.Share buyback, also known as share repurchase, is a process through which a company purchases its own outstanding shares from the market or directly from its shareholders. The primary reason for share buybacks is to distribute excess cash to the shareholders, improve financial ratios such as EPS, and/or express confidence in the future business operations of the company.In extension, a buyback tax is a imposed on companies when they repurchase their own shares from shareholders. Governments typically use this tax to discourage firms from returning profits through buybacks instead of distributing them as dividends.Buybacks will now be taxed as capital gains in the hands of all shareholders, replacing the earlier structure that often led to uneven tax outcomes. However, to control misuse, promoters will face an additional buyback tax, pushing the effective tax rate to 22 per cent for corporate promoters and 30 per cent for non-corporate promoters. “Change in taxation of buyback was brought in to address the improper use of buyback route by promoters,” said Sitharaman.

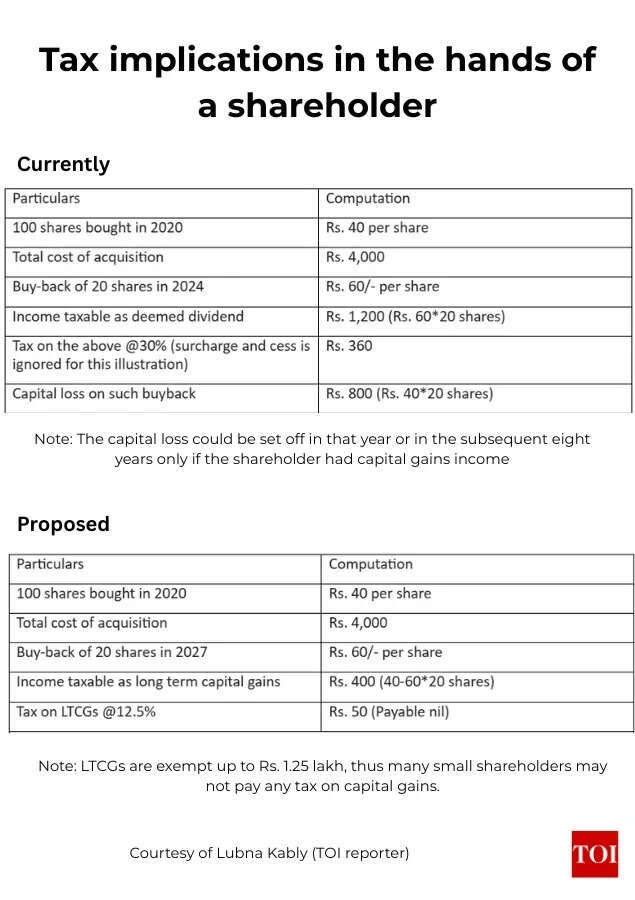

Experts believe this could make buybacks less attractive for promoter groups and encourage companies to reconsider capital allocation strategies, possibly shifting toward dividends, capital expenditure or research and development. For individual investors, however, the change could mean a more favourable tax treatment compared to being taxed at the highest income slab rates earlier.Roop Bhootra, Whole-time Director at Anand Rathi Share and Stock Brokers, said the proposal benefits individual shareholders, as their tax burden would fall from the highest slab rate of 30 per cent to capital gains tax rates — 20 per cent for short-term and 12.5 per cent for long-term gains. However, he noted that the move is negative for corporates, as it discourages buybacks and may prompt companies to deploy reserves toward capital expenditure or research and development instead, as quoted by PTI.The buyback tax framework currently in force was introduced in Budget 2024 and became effective from October 1, 2024. Under these rules, the tax burden on share buybacks was shifted from companies to shareholders. Amounts received by shareholders from a buyback are treated as dividend income and taxed according to the shareholder’s applicable income tax slab. The company undertaking the buyback is required to deduct Tax Deducted at Source (TDS) before making the payment.For resident individuals, TDS is deducted at 10 per cent if the buyback proceeds are Rs 5,000 or more. For non-resident individuals, TDS is deducted at 20 per cent, subject to relief under an applicable tax treaty.At the same time, the cost of acquisition of the shares tendered in the buyback is treated as a capital loss in the hands of the shareholder. This loss may be classified as short-term or long-term depending on the holding period and can be set off against other capital gains or carried forward for up to eight assessment years.

NRIs get wider access to Indian equities

In a market-friendly reform, the government has proposed allowing individual Persons Resident Outside India (PROI) to invest in shares of listed Indian companies through the Portfolio Investment Scheme.The investment limit for an individual PROI will be raised to 10 per cent from 5 per cent, while the overall cap for all such investors will increase to 24 per cent from the current 10 per cent.Market experts said the move could broaden India’s investor base, improve liquidity and bring in more stable, long-term capital. By attracting overseas Indians who understand domestic market dynamics, the reform may also help reduce dependence on more volatile institutional flows and support currency stability over time.

Borrowing to invest?

To discourage borrowing for investments in the stock market and mutual funds, the finance minister has proposed disallowing the deduction of interest paid on such loans against investment income.Currently, investors who take loans to buy shares or mutual fund units can claim the interest paid as a deduction—up to 20% of the income earned—against dividends or other investment income, with the remaining amount taxed under ‘income from other sources’. Under the proposed change, this tax benefit would be withdrawn.Ameet Patel, chief risk partner at Manohar Chowdhry & Associates, said the move aligns with the government’s repeated concerns over excessive speculation in capital markets. “Time and again, we have heard from regulators and the government that there is too much speculation in the capital markets, which is not in the interest of common investors. This proposal is a clear move to discourage investors from borrowing money to invest in securities,” he said.

Stock market’s panic-stricken sentiment on Budget Day

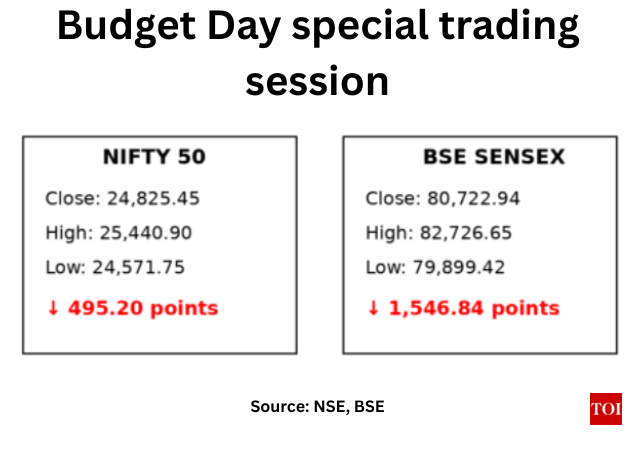

Stock markets reacted sharply to Finance Minister Nirmala Sitharaman’s Union Budget 2026 speech, with the Nifty50 falling below 25,000 and the BSE Sensex dropping over 1,600 points in early trading. Investors were spooked by the hike in Securities Transaction Tax (STT) on futures and options, which raised trading costs and prompted aggressive selling in brokerage, exchange, and high-volume market stocks. The performance did not improve much by closing. Sensex was at 1,546.84 points to close at 80,722.94, while the Nifty fell 495.20 points to settle at 24,825.45.

The downturn quickly spread beyond derivatives-related counters, with heavyweights like Reliance Industries and State Bank of India also declining. Small- and mid-cap indices fell 2–3 per cent, reflecting broad-based risk aversion. While Budget 2026 supports infrastructure, manufacturing, and digital-led growth, the absence of capital gains tax relief and the STT hike create short-term headwinds.Narendra Solanki, Head of Fundamental Research – Investment Services at Anand Rathi Share and Stock Brokers Limited, talked about his view on why the stock markets were reacting sharply. “Markets witnessed a knee-jerk reaction following the unexpected hike in STT on Futures and Options, as hopes of a reduction in capital gains tax had already been priced in,” he said.Meanwhile, Somil Mehta, Head of Retail research at Mirae Asset Sharekhan gave his insights on how to navigate the volatality now saying, “The Budget is clearly supportive of infrastructure, manufacturing, and digital-led themes. However, the absence of capital gains tax relief and the increase in STT create near-term headwinds for the broader market. Investors should remain selective, focus on quality sectors with strong policy visibility, and avoid aggressive short-term bets.““Defensive allocation and long-term positioning remain key in navigating post-Budget volatility. Markets were expecting relief on LTCG and STCG taxation, but no proposals were announced, which may result in continued FII selling. Adding to the pressure, the hike in STT on futures and options acts as a broad-based negative for market sentiment. Positive sectors to watch Railways, Electronics, Semiconductors, Pharma, Metals & Mining, and Data Centers. Strategy is to stay diversified, focus on structural growth sectors, and maintain a cautious approach in the near term,” he added.(Disclaimer: Recommendations and views on the stock market and other asset classes given by experts are their own. These opinions do not represent the views of The Times of India)