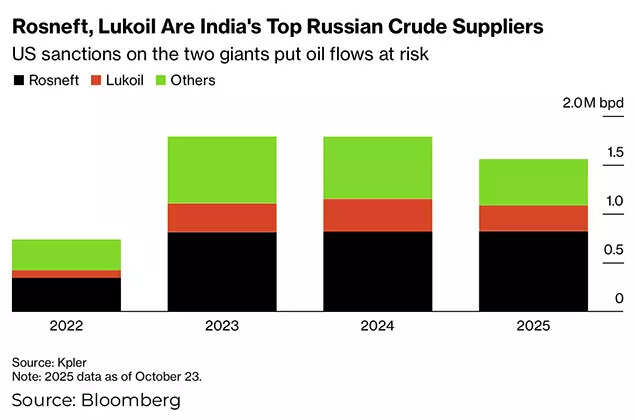

US President Donald Trump’s move to impose sanctions on two of Russia’s largest oil suppliers – Rosneft and Lukoil – spells bad news for India’s private sector refineries Reliance Industries (RIL) and Russia-backed Nayara Energy.Analysts are of the view that the latest round of sanctions may hit earnings of these two oil refineries. According to an ET report citing industry analysts, the sanctions imposed by the United States are expected to reduce Reliance Industries’ EBITDA by approximately ₹3,000-3,500 crore.Earlier, India relied heavily on Middle Eastern imports. However, after the Russia-Ukraine war began in early 2022 and the G7 imposed a $60-per-barrel price ceiling on Russian oil revenues, India shifted focus to procuring Russia’s crude available at heavy discounts.

How will Trump sanctions on Russia oil impact Reliance, Nayara?

The sanctions announced by Trump will be a blow to Reliance and Nayara Energy Additional impact is expected on government-operated oil marketing firms including Indian Oil Corporation, Bharat Petroleum Corporation, and Hindustan Petroleum Corporation.

Rosneft, Lukoil are India’s top Russian crude suppliers

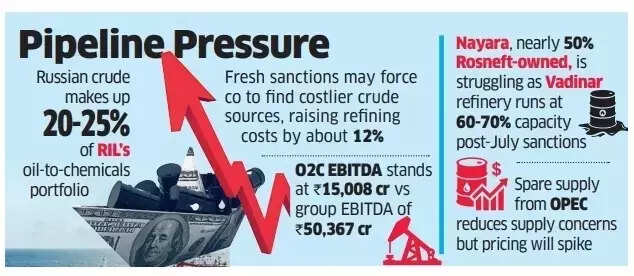

Industry experts believe that Russian oil makes up approximately 20-25% of RIL’s oil-to-chemicals operations. The company currently has an agreement to purchase roughly 500,000 barrels of crude daily from Rosneft.“RIL, which had signed a crude supply deal with Rosneft, will not be able to honour their agreement given the fresh sanctions,” said an analyst tracking RIL, adding that the move could raise refining segment costs by about 12% as they seek alternative crude sources.The company’s current O2C segment EBITDA stands at ₹15,008 crore, whilst the total group EBITDA is recorded at ₹50,367 crore.Also Read | ‘Strong immunity to Western restrictions’: Russia hits out as Trump sanctions its oil firms; ‘step entirely counterproductive’“Therefore, even if there is a hit, the maximum impact could be about ₹3,000-3,500 crore. From a group perspective, RIL may be able to absorb this and move on,” the analyst continued.Experts indicate that for each $1 rise in gross refining margin, RIL sees a 2% growth in consolidated EBITDA and a 3-4% boost in net profit. RIL’s second quarter financial report revealed that whilst O2C segment EBITDA improved quarter-on-quarter due to higher fuel cracks, it was partly counterbalanced by the original selling price of Middle East crude and reduced downstream margins.

Sanctions on Russian oil firms: Pipeline pressure

Industry observers suggest that government-operated oil marketing firms could face greater risks from the recent sanctions, considering that refining and marketing constitute their primary operations.“Even though the state-run OMCs don’t have term contracts, they have been receiving a steady supply of crude from Russia. Losing 30% of crude supply and facing a $2-3 per barrel hit on discounts could significantly affect overall numbers,” noted an analyst, explaining that a mere $1 reduction in gross refining margins can diminish total earnings by 9-10%.Also Read | No oil from Russia soon? Trump sanctions to hit India’s crude imports; ‘all but impossible for flows to continue’The situation at Nayara Energy, in which Rosneft has approximately 50% ownership, indicates potential difficulties in obtaining crude and marketing refined products. Currently, their Vadinar refinery in Gujarat operates at 60-70% capacity following the first set of EU sanctions implemented in July.Industry experts indicate that OPEC’s available crude capacity could help address supply issues, though prices will be impacted. “Middle Eastern crude is available in ample supply, but the new sanctions are expected to spike prices,” according to a market observer.