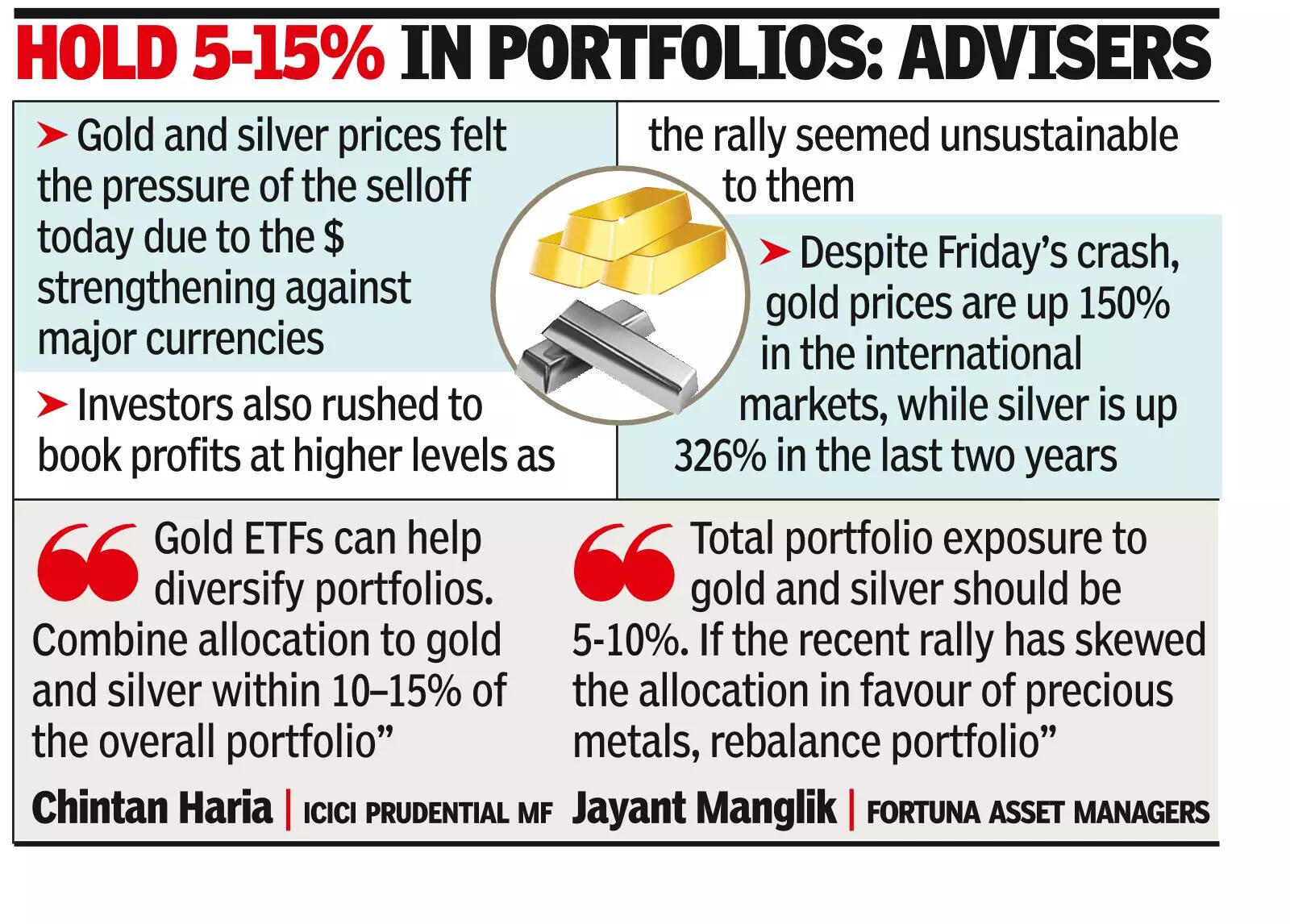

Mumbai: Friday’s sharp slide in silver and gold prices could be due to profit taking by investors post an unprecedented rally that came on the back of the recent strengthening of the dollar against major currencies. For long term investors this could be a time to rebalance their portfolio, with exposure to the two precious metals at a maximum of 15%, fund managers and investment advisors said.In late trades on the MCX on Friday, silver future contracts for March delivery were trading at Rs 3 lakh/kg level, down by over Rs 1 lakh or 25%. Compared to the slide in white metal’s price, the slide in gold prices was less. Futures contracts for Feb delivery were trading at Rs 1.5 lakh/10gm, down Rs 15,200 or 9%. In the local bullion market, silver settled at Rs 3.45 lakh while gold was at Rs 1.66 lakh.“The main reason for the selloff was the strengthening of the US dollar, putting pressure on gold and silver prices. Investors also felt that the recent rally was stretched and unsustainable, leading to profit-booking at higher levels,” said Satish Dondapati, Fund Manager, Kotak Mutual Fund. “The fall was further supported by a technical correction, as prices had risen very quickly in a short period, making the market overheated.”Despite Friday’s crash, in the last two years in the international markets, while gold prices are up 150%, silver is up 326%.Not surprisingly, fund managers and investment advisors say that long term investors should have up to 15% exposure to these two metals in their portfolio.“Expectations of US rate cuts have lowered the opportunity cost of holding non-yielding assets like gold. Concerns around the AI-driven equity bubble in the US have also encouraged diversification into gold.” said Chintan Haria, Principal Investment Strategy, ICICI Prudential Mutual Fund.

.

According to Haria, while short-term corrections may be natural after sharp moves, the broader environment remains supportive over the medium term.“If you are sticking to the principles of asset allocation, together the exposure to gold and silver in your portfolio should be 5-10%,” said Jayant Manglik, partner, Fortuna Asset Managers.The strategy should be to book profits in silver first. Then rebalance the portfolio to a ‘neutral’ position by trimming the holdings in precious metals back to a safe haven level. Then “move harvested gains into diversified Indian equity funds or blue-chip stocks,” a recent report by WhiteOak Capital MF said.