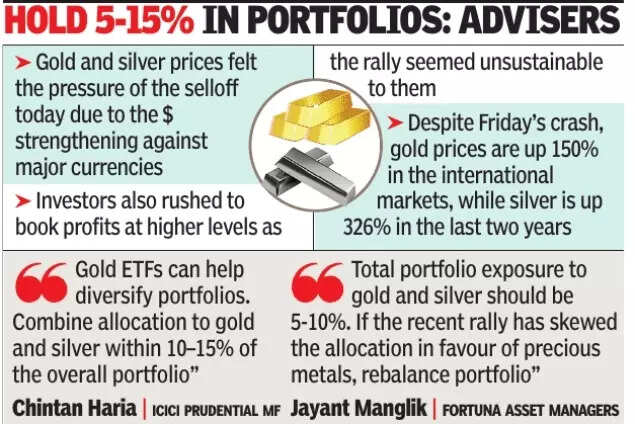

Trillions wiped out – gold and silver prices crash globally – the headlines from the commodity market on Friday described the volatile nature of the commodity market. Gold and silver have been on a record breaking spree for several months now, climbing to new lifetime highs every few days. The sudden crash, and the extent of it – took markets by surprise.Gold prices dropped by a whopping Rs 14,000 per 10 grams and silver prices tanked by Rs 20,000 per kg in Delhi on Friday. The sharp dip came after gold hit a fresh high of Rs 1,83,000 and silver of Rs 4,04,500 on Thursday. Both the precious metals have plunged sharply – gold is down nearly 10%, while silver has slumped about 20% from the record highs.On Friday, in late trades on the MCX, gold futures for February delivery were down to Rs 1.5 lakh/10 grams, while the silver futures for March delivery crashd to Rs 3 lakh/kg, down over Rs 1 lakh.According to Mirae Asset ShareKhan data, in last two days, gold’s market cap is down by around $3.50 trillion, while silver has lost around $1.50 trillion – which is a combined drop of $5 trillion! Still, gold’s market cap is up by around $3 trillion since the start of the year, while silver has gained around $2 trillion. In fact, despite the crash on Friday, in the last two years gold prices are up 150% and silver has gained 326% in international markets.

Why gold & silver crashed suddenly?

Several factors led to the sudden crash in the prices of the precious metals. For one, prices had run up too sharply, and some but of profit booking was expected. Some analysts are of the view that the decline in prices was due to heavy liquidation of long positions. A record in dollar also added pressure to gold.Experts also say that US President Donald Trump’s pick for the post of US Federal Reserve – Kevin Warsh – sent jitters in markets as he is known to be an inflation hawk, tempering expectations of rate cuts.

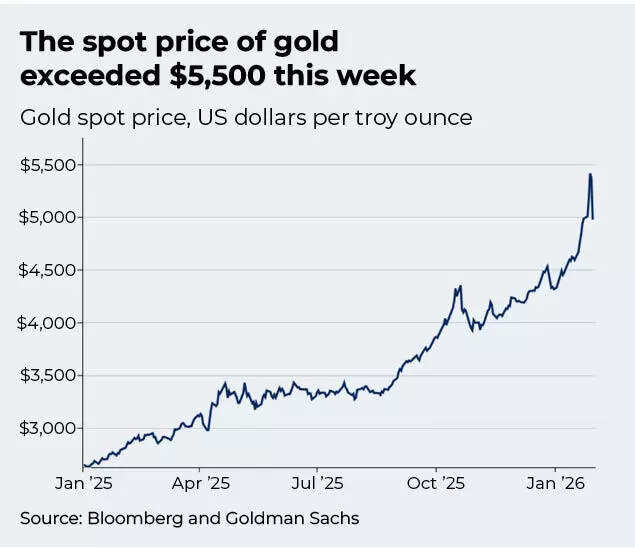

Spot price of gold exceeded $5,500 this week

Maneesh Sharma, AVP – Commodities & Currencies, Anand Rathi Shares and Stock Brokers tells TOI, “Gold & Silver which peaked in overnight on Thursday trade fell sharply after six of the Mag 7 equities related to AI stocks got hammered during the North American session. On Wednesday, US Fed also maintained the status quo, keeping rates unchanged after revealing an improvement in the labor market. Regarding inflation, they said that it remains elevated and sticks to its data-dependent and meeting-by-meeting approach.”“Sharp moves in precious metals seen on Friday reflected speculation that Warsh may be less enthusiastic to cut rates given his past warnings of inflation risks and more recent calls for the Fed to reduce its balance sheet. This led to a rise in Dollar & Yields weighing on sentiments for bullions complex,” Sharma explained.Praveen Singh, Head of Commodities Mirae Asset ShareKhan tells TOI that Warsh’s nomination came as a surprise, as Rick Rieder, BlackRock’s Global Fixed Income CIO, had been widely viewed as the frontrunner. “Rieder, who has advocated for aggressive rate cuts to support economic growth, was seen as favouring a dovish monetary stance aligned with President Trump’s policy preferences.”

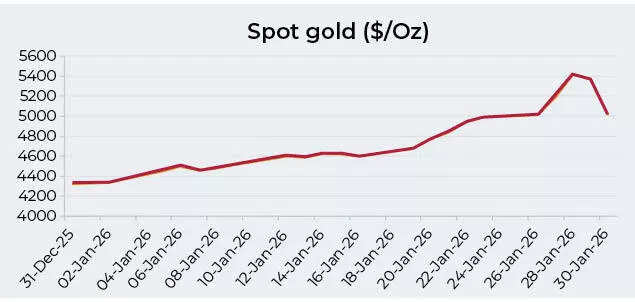

Spot gold sudden crash

“In contrast, Warsh is a well‑known monetary hawk. During his five‑year term on the Federal Reserve Board, which ended in 2011, he consistently pushed back against what he viewed as overly accommodative policy. He warned that near‑zero interest rates and large‑scale asset purchases risked market distortions and long‑term price instability. Warsh voted against QE2 in 2010 and criticized the Fed for going too far with post‑crisis stimulus. He has also remained critical of the Fed’s large balance sheet and spoke out against rate cuts in 2024,” Praveen Singh said.According to Praveen Singh, by choosing Warsh, Trump has effectively signalled a commitment to upholding the Federal Reserve’s independence, despite the political pressures surrounding monetary policy.Yet another factor that is at play is easing geopolitical situation. “While geopolitical tensions remain elevated, the situation has eased somewhat as Iran has signaled a willingness to engage in dialogue with the United States—provided Washington ends its threats against the Islamic Republic. The US President, meanwhile, is keeping all options open,” Praveen Singh explains.Investors are also cautious ahead of several key US macroeconomic releases next week, including ISM Manufacturing, ISM Services, and Non‑Farm Payrolls. With the Fed signaling an extended pause in rate cuts at its January 28 FOMC meeting—citing a stabilizing job market and resilient economic conditions—strong data would reinforce the central bank’s current stance, says Singh.

What’s the outlook for gold, silver prices in coming days?

Maneesh Sharma of Anand Rathi Shares and Stock Brokers says that going ahead markets could now look ahead to more cues from labor market reports due next week in US which could show signs of weakening labor markets, while local markets could remain glued towards Union budget announcement due on Sunday (Budget 2026). “Any signs of changes in import duty structure could reflect directly into MCX prices as MCX futures prices include customs duty value,” he says.Also news that Shanghai Futures Exchange will widen trading limits of some silver futures to 17% from 16%, effective from settlement after market close on February 3, according to an exchange statement could now weigh further on price sentiments in Monday’s trade creating sharp volatile moves in prices in coming few sessions, Sharma says.“Overall on a technical front volatility is expected to continue in prices for few more sessions as strong supports for silver prices persist around today’s low @ $ 95.10/Oz in spot markets (CMP $ 100.75/Oz). A weekly close below the same level only calls for a corrective bias towards 90 – 89 $/Oz where prices are expected to stabilize next week. On MCX this could translate to a strong support in the range of Rs. 3,04,000 – 2,92,000 per Kg (CMP Rs. 3,41,750/kg – Mar Futures. contract). Overall we expect a trading range of 95 – 107 $/Oz in next 1-2 weeks perspective. For gold trading range remains around $ 4780 – 5260 for 1-2 weeks perspective,” Maneesh Sharma tells TOI.

While the short term volatility in any asset is usual, the important question is: Is the gold, silver bull run over?

Maneesh Sharma of Anand Rathi Shares and Stock Brokers is still bullish on gold and silver, expected new highs in the coming quarters.“Sharp run up in prices seen in the current month was due for correction, but that does not mean that the bull run is over. We expect prices to stabilize in next 2-3 weeks perspective. Meanwhile in the medium term prices are expected to consolidate in the second half of the current quarter,” he says.

Gold, silver: What should investors do?

“Overall we still expect prices to hit new highs in Q2-Q4 time period as we still see gold to cross $6000 /Oz in H2 2026. Also silver may see levels of $130-135 in spot market in the second half of the year,” he adds.Goldman Sachs has also said that the rally in gold prices is far from over. Anshul Sehgal, global co-head of Fixed Income, Currency and Commodities in Goldman Sachs Global Banking & Markets, says the precious metal could continue to rise.“The main driver of the move has been global central banks’ shift from the US dollar to precious metals. These are tiny markets compared to global stocks or fixed income, so the smallest change in demand makes prices go parabolic,” Sehgal has said.Sehgal is of the view that only 5% of the world’s gold is currently held by speculators. “If a central bank decides they want to pivot away from the dollar and own more gold, that is going to move the price quite violently. Which is what we’re observing. Do we expect gold to continue to appreciate exponentially as it has? No. But we’re not fussed about there being a lot of froth when it comes to precious metals,” he has said.Praveen Singh of Mirae Asset ShareKhan is also confident that the bull run in both the precious metals remains intact. He believes the bull run is supported by a broad set of powerful structural drivers. These include persistent fiscal concerns, heightened geopolitical instability, rising global fragmentation, increasingly isolationist US policies, eroding trust in the US dollar, the use of economic sanctions as a policy weapon, an unsustainable US fiscal trajectory, growing fragility in bond markets, and the weakening of the long‑standing rules‑based international order.“Silver will continue to benefit on high gold prices and record high industrial demand amid supply constraints. It remains indispensable metal in green energy transition,” he adds.So, what levels will gold and silver hit by year-end? Praveen Singh expects gold to rise to $6000-$6500 levels, while silver is expected to rise to $150. In rupee terms, gold is expected to rise to Rs 200,000 and silver can reach Rs 500,000.(Disclaimer: Recommendations and views on the stock market, other asset classes or personal finance management tips given by experts are their own. These opinions do not represent the views of The Times of India)