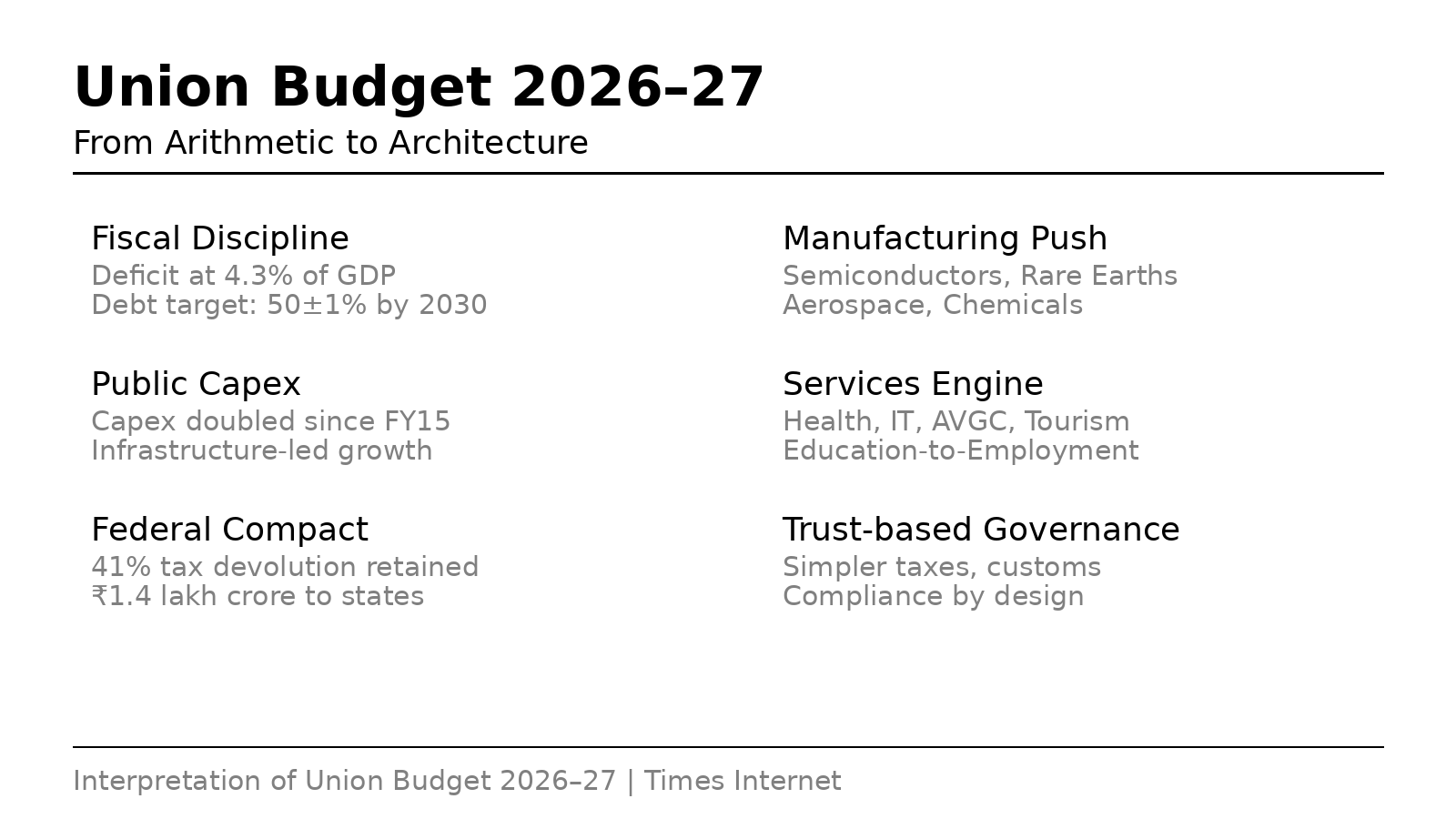

Budgets are usually judged the way exam papers are: marks for effort, grace marks for intent and a generous curve for political difficulty. But this year’s Budget deserves to be read differently; not as an annual fiscal statement but as the first operational document of a longer constitutional cycle that began with the 16th Finance Commission.If the Finance Commission sets the grammar of Centre–state relations for five years, this Budget is the first full sentence written in that grammar and its subtext is clear: this government is trying to convert macro stability into institutional endurance.The most consequential decision is also the quietest. The Centre has accepted the Commission’s recommendation to retain 41% vertical devolution to states. In an era where political economy is increasingly centralised in rhetoric if not always in law, this is a signal worth underlining. It anchors federal trust even as the Centre tightens its own fiscal belt. The Budget’s fiscal deficit for 2026–27 is pegged at 4.3% of GDP, with a clear glide path towards a 50±1% debt-to-GDP ratio by 2030. This is not austerity. It is choreography.What makes Finance Minister Nirmala Sitharaman’s 9th Budget in a row distinctive is its refusal to choose between growth and discipline. Instead it attempts a third path: sustained public investment backed by predictable fiscal behaviour. Effective capital expenditure rises sharply, public capex has more than doubled since FY15, and yet the revenue deficit continues to compress. This is the fiscal equivalent of saying: we will build, but we will also keep our balance.Nowhere is this clearer than in infrastructure. This Budget is unapologetically physical. Freight corridors from Dankuni to Surat, 20 new national waterways, high-speed rail “growth connectors” stitching together industrial clusters.

Asset recycling through REITs and InVITs, an Infrastructure Risk Guarantee Fund to crowd in private capital without socialising losses recklessly. This is not ribbon-cutting economics. It is logistics as statecraft.But infrastructure here is not merely concrete, it is also institutional. The restructuring of PFC and REC, a market-making framework for corporate bonds, and a comprehensive review of FEMA rules all point to a government that recognises its next growth constraint is not ambition, but financial plumbing. Raising STT on derivatives will without doubt irritate traders, but it also signals an intent to curb excess froth without spooking long-term capital.The manufacturing push, often announced with great enthusiasm in past Budgets feels more granular this time. Instead of another broad-brush PLI flourish, we see targeted interventions: semiconductors 2.0, rare earth magnets, container manufacturing, aerospace components, chemical parks, and the revival of 200 legacy industrial clusters. Tax and customs reforms—safe harbours, bonded warehousing, deferred duty payments—are less about incentives and more about reducing friction . This is manufacturing policy written by people who have finally listened to factory floors.MSMEs, the eternal footnote of Indian growth, get something close to an ecosystem approach. Equity support through a ₹10,000 crore growth fund, liquidity via mandatory TReDS usage by CPSEs, secondary market for receivables and ‘Corporate Mitras’ to help small firms survive compliance without bleeding cash. It is not revolutionary, but it is practical, which, in policy, is often better.Services, long treated as India’s silent overachiever, are brought decisively into the centre of the narrative:

- Medical value tourism hubs.

- Education-to-employment committees.

- AVGC creator labs in schools.

Sports, design, caregiving, allied health – all recognised as serious economic engines rather than cultural afterthoughts.The tax proposals for IT and cloud services, including extended safe harbours and data centre incentives until 2047, quietly acknowledge where India’s comparative advantage now lies .What may be politically underplayed but economically profound is the people-centric architecture of the Budget. A national care ecosystem. Mental health institutions. Emergency trauma centres. Divyangjan skilling and assistive device manufacturing. These are not welfare announcements designed for applause lines. They are productivity investments for an ageing, urbanising society.Finally, this Budget’s trust-based governance measures: customs automation, extended advance rulings, decriminalisation of minor tax offences, simplified remittance rules signal a philosophical shift. The state is attempting to move from suspicion to verification, from control to compliance by design. Whether implementation keeps pace is an open question, but the direction is unmistakable.Put together, this Budget is less a populist flourish and more a systems document. It assumes the hard political work of stabilisation has been done and turns to the harder administrative task of execution. In that sense, it mirrors the Finance Commission itself: technocratic, quietly consequential, and designed to outlast the news cycle.The real test will not be market reaction on Monday morning but whether states feel empowered rather than constrained, whether private capital feels crowded in rather than crowded out and whether citizens experience the benefits not as schemes but as normalcy.This Budget does not promise miracles. It promises continuity with intent, and, in an uncertain global economy, that may be its most underrated virtue.