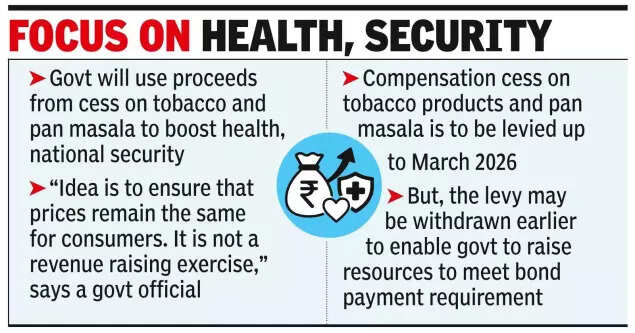

NEW DELHI: The Centre is set to levy a new cess on tobacco, tobacco products and pan masala after the phaseout of GST compensation cess to ensure that price of these products do not fall as they are sin goods.At the time of GST revamp, govt had announced continuation of compensation cess only for tobacco and pan masala, while withdrawing it on all other products and changing the rates, which resulted in lower levy for several products. Some of the goods had moved into the 40% sin goods bracket.

While the compensation cess on tobacco products and pan masala is to be levied up to March 2026, there is a possibility of the levy being withdrawn earlier as the Centre will be able to raise resources to meet the bond payment requirement. As a result, the health and security cess that is proposed on these two sin goods segments will kick in from the date that will be notified.On Monday, finance minister Nirmala Sitharaman is scheduled to introduce a bill “to augment the resources for meeting expenditure on national security and for public health, and to levy a cess for the said purposes on the machines installed or other processes undertaken by which specified goods are manufactured or produced and for matters connected therewith or incidental thereto”, according to the business listed for the Lok Sabha.The move also paves the way for the govt to allocate more resources for defence, amid heightened tension in the neighbourhood.Govt is hoping that the bill is passed during the Winter Session itself so that the date can be notified, whenever required.At the time of the GST revamp announcement in Sept itself, govt had indicated that a new cess will be imposed on the two products. “The idea is to ensure that prices remain the same for consumers. It is not a revenue raising exercise,” said a govt official.At the time of the launch of GST in 2017, the Centre and the states had agreed to the compensation cess on sin and luxury goods, such as cars, yacht, soft drinks, coal, tobacco and pan masala. The idea was to ensure that states were assured of an annual 14% increase in their indirect tax kitty for five years. Covid outbreak and the lockdown, however, upset the calculations resulting in the cess continuing till March 2026, until the GST Council agreed to the restructuring earlier this year.