NEW DELHI: Prime Minister Narendra Modi on Sunday hailed Union Budget 2026 as a “highway of immense opportunities”, saying the “Reform Express” on which India is riding will draw fresh energy and momentum from the proposals announced by finance minister Nirmala Sitharaman.Sitharaman, presenting her ninth consecutive Union Budget, anchored her speech around three “kartavyas” or duties:

- Accelerating and sustaining economic growth by enhancing competitiveness

- Meeting aspirations

- Ensuring every family, community and region has access to resources and opportunities for participation.

In his remarks, Modi praised the finance minister’s record run, calling the Budget “historic” and a “strong reflection of India’s ‘Nari Shakti’. “Nirmala Sitharaman has set a record of presenting the budget for the ninth consecutive time as a woman finance minister,” he said.So what does Budget 2026 offer to everyone? Here’s are top 10 winners and losers of Union Budget 2026

WINNERS

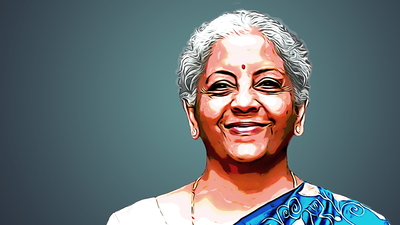

1. Nirmala Sitharaman

Finance minister Nirmala Sitharaman created history by presenting a record ninth consecutive Union Budget, taking her closer to the all-time mark of 10 budgets delivered by former prime minister Morarji Desai over different periods.Former finance ministers P Chidambaram and Pranab Mukherjee had also presented multiple budgets — nine and eight, respectively — though under different prime ministers.Sitharaman, however, holds the unmatched record of delivering the maximum number of Budgets on the trot, with nine straight under Prime Minister Narendra Modi. Appointed India’s first full-time woman finance minister in 2019, she retained the portfolio after Modi returned to power in 2024 for a third term.

2. Tourism

Sitharaman pitched tourism as a key pillar of a ‘Viksit Bharat’, unveiling proposals that span heritage conservation, skill development, digital mapping and infrastructure creation. The Budget outlines plans to develop ecologically sustainable mountain trails, turtle trails and bird-watching trails in select states, and to create Buddhist circuits across the northeastern states of Arunachal Pradesh, Sikkim, Assam, Manipur, Mizoram and Tripura. In a major heritage push, the government will develop 15 archaeological sites into “vibrant experiential cultural destinations”, including Lothal, Dholavira, Rakhigarhi, Sarnath, Adichanallur, Hastinapur and Leh Palace. Sitharaman said excavated landscapes will be opened to the public through curated walkways, backed by immersive storytelling tools, conservation labs, interpretation centres and trained guides. The Budget also linked tourism to regional development through an integrated East Coast Industrial Corridor with a well-connected node at Durgapur, creation of five tourist destinations across Purvodaya states, and the deployment of 4,000 e-buses.The Budget also placed a spotlight on eco-tourism and nature-led travel. Finance Minister Nirmala Sitharaman said, “India has the potential and opportunity to offer world-class trekking and hiking experience.” As part of this push, the government will develop sustainable mountain trails in Himachal Pradesh, Uttarakhand and Jammu and Kashmir, as well as in Araku Valley in the Eastern Ghats and Pudigai Malai in the Western Ghats.The Budget also proposed dedicated trails to promote wildlife tourism, including turtle trails along key nesting sites in Odisha, Karnataka and Kerala, and bird-watching trails around Pulicat Lake.

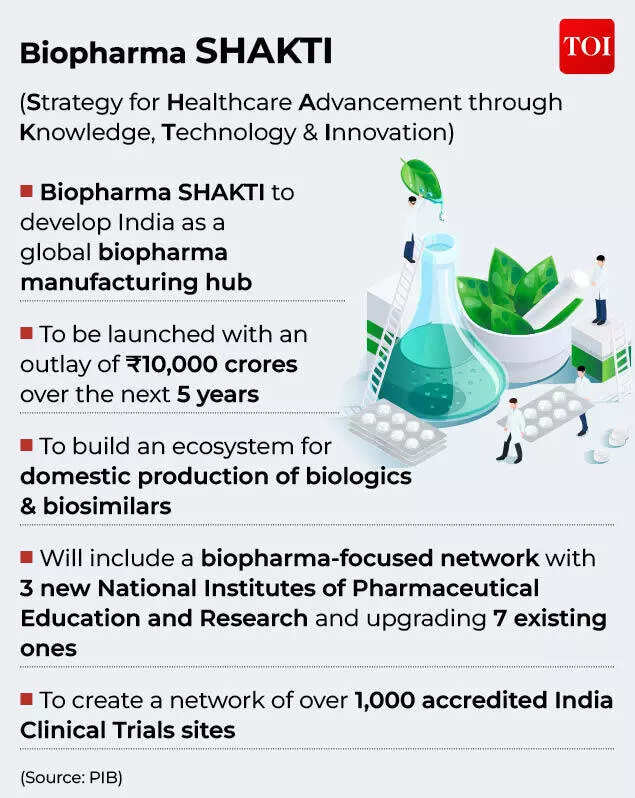

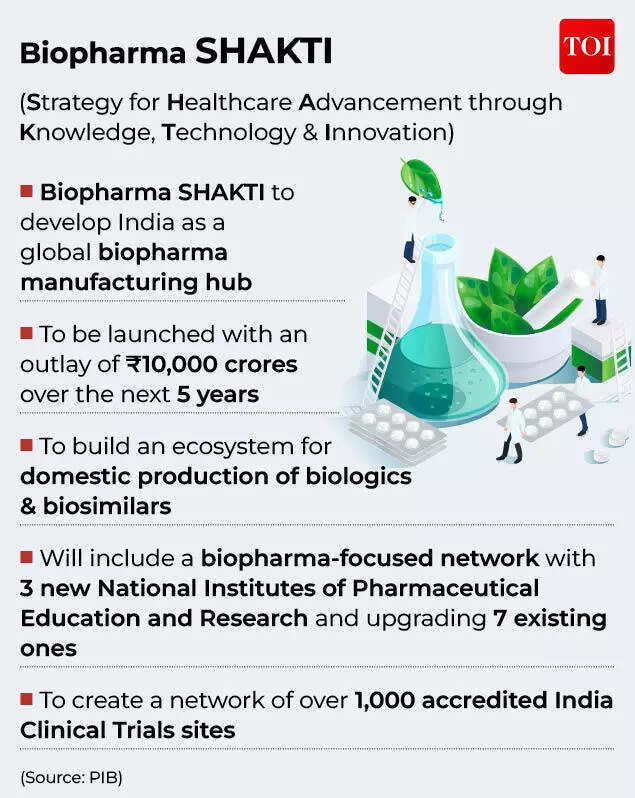

3. Pharmaceuticals

Sitharaman proposed an investment of Rs 10,000 crore in the biopharma sector over the next five years, a move expected to boost India’s pharmaceuticals industry. Biopharmaceuticals, or biologics, are complex medicines produced from living organisms, cells or tissues, rather than through chemical synthesis.In her Budget speech, Sitharaman also outlined interventions across six areas, including manufacturing, strategic and frontier sectors, healthcare and advanced technology.

The government on Sunday proposed a scheme to help states set up five regional medical hubs in partnership with the private sector, aiming to promote India as a leading medical tourism destination.Presenting the Union Budget 2026-27, Finance Minister Nirmala Sitharaman said these hubs will function as integrated healthcare complexes, bringing together medical services, education and research facilities.She also announced plans to upgrade existing institutions for Allied Healthcare Professionals (AHPs) and establish new AHP institutions across both the government and private sectors. “This will cover 10 selected disciplines, including Optometry, Radiology, Anaesthesia, OT technology, Applied Psychology and Behavioural Health, and add 100,000 AHPs over the next five years,” Sitharaman said.The finance minister said the government will also build a stronger care ecosystem covering geriatric and allied care services, and will train 1.5 lakh caregivers over the coming year in allied skills such as wellness, yoga and operation of medical and assistive devices.Of the Rs 1,06,530.42 crore allocated to the ministry of health and family welfare, Rs 101,709.21 crore has been earmarked for the department of health and family welfare, and Rs 4,821.21 crore for the department of health research.

4. Women

Sitharaman announced measures aimed at boosting women entrepreneurship, building on the success of the Lakhpati Didi programme. She proposed setting up “Self Help Entrepreneur (SHE) Marts” as community-owned retail outlets run by women-led self-help groups within cluster-level federations, supported through enhanced and innovative finance instruments. The initiative is expected to improve market access for products made by women and create sustainable livelihoods at the community level. Sitharaman said the focus is shifting from credit-linked livelihoods and small loans to helping women scale businesses and become owners of enterprises, stakeholders and decision-makers in supply chains.

5. Textiles

An integrated programme to boost the labour-intensive textile sector, along with a proposal to set up mega textile parks, was also announced. The five-part programme includes a National Fibre Scheme to promote self-reliance in natural, man-made and new-age fibres, and a Textile Expansion and Employment Scheme to modernise clusters through machinery support, technology upgrades, and testing/certification centres. The Budget also proposed a National Handloom and Handicraft programme, a Tex-Eco Initiative for sustainable textiles, and Samarth 2.0 to strengthen skilling. The Centre will launch Mahatma Gandhi Gram Swaraj for branding and market linkages, and extend export timelines from six months to one year for select exporters.

LOSERS

6. Poll-bound states

Last year, with the Bihar assembly elections in focus, the Centre announced the National Makhana Board in the state with an initial budget allocation of Rs 100 crore.However, unlike previous years, poll-bound states did not receive much attention in the Union Budget. Chief ministers of West Bengal, Tamil Nadu and Kerala strongly criticised the Budget, alleging that the Centre had ignored their states.In the Union Budget, the only major proposal for West Bengal was the announcement of a new dedicated freight corridor from Dankuni in the east to Surat in the west, aimed at promoting environmentally sustainable cargo movement.Tamil Nadu, meanwhile, was included in the Centre’s announcement to support mineral-rich states—along with Odisha, Kerala and Andhra Pradesh—in establishing dedicated rare earth corridors.For Kerala, Sitharaman announced the establishment of turtle trails along key nesting sites in the coastal areas of Odisha, Karnataka and Kerala.

7. Markets

Domestic equity markets came under sharp selling pressure on Sunday during Finance Minister Nirmala Sitharaman’s Union Budget 2026 speech, after the government proposed a steep hike in Securities Transaction Tax (STT) on futures and options (F&O) trades.The Nifty 50 fell 1.45% to 24,953.05, while the Sensex slipped 1.27% to 81,221.97. The drop followed the announcement raising STT on futures from 0.02% to 0.05% and on options premium from 0.1% to 0.15%. STT on the exercise of options was also raised to 0.15%. Higher transaction costs sparked anxiety, especially among frequent traders and hedgers, triggering a broad sell-off.

8. Traders

Government proposed increasing the securities transaction tax (STT) on equity futures to 0.05% from 0.02%. The STT on options premium, as well as on the exercise of options, is proposed to be raised to 0.15%.The announcement triggered a sharp market reaction, with the NSE Nifty 50 sliding nearly 3% in intraday trade before trimming some losses. Stocks linked to market infrastructure and trading took a hit, with BSE Ltd., India’s second-largest stock exchange, and brokerage firms including Angel One Ltd. declining sharply.The proposed tax hike underlines government’s intent to rein in speculative trading following a surge in retail participation that has made the country a major market for such products by contracts traded. The regulator had already introduced curbs in late 2024, including restricting each exchange to one weekly index options contract.

9. Promoters

Sitharaman announced a major overhaul of buyback taxation in Union Budget 2026-27 to protect minority shareholders and curb promoter-led tax arbitrage. She announced that share buybacks will be taxed as capital gains for all categories of shareholders. To discourage misuse, promoters will face an additional buyback tax, raising the effective rate to 22% for corporate promoters and 30% for non-corporate promoters. Sitharaman said the change targets the “improper use” of the buyback route by promoters. Market experts said the higher promoter tax burden could push companies to rethink capital allocation choices between buybacks and dividends.

10. Bangladesh, Chabahar Port

India has reworked its overseas development assistance in Budget 2026, raising overall “Aid to Countries” allocation to Rs 5,686 crore (about 4% higher than last year’s Budget estimates) but below the 2025–26 revised estimates. The biggest shift is zero funding for Iran’s Chabahar port project, after allocations of Rs 400 crore in 2024–25 and Rs 400 crore in 2025–26 RE, despite a 10-year operating agreement signed in 2024. Aid to Bangladesh has also been cut in half from Rs 120 crore to Rs 60 crore. Bhutan remains the top recipient (Rs 2,289 crore), while allocations to Nepal (Rs 800 crore) and Sri Lanka (Rs 400 crore) have been increased.