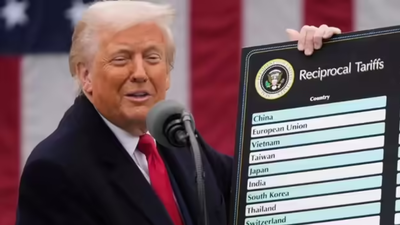

US President Donald Trump on Thursday signed a proclamation imposing a 10 per cent temporary import surcharge on most goods entering the United States, after the Supreme Court deemed the tariffs imposed on different countries “illegal”.Thereafter, invoking emergency powers under Section 122 of the Trade Act of 1974 to address what he described as “fundamental international payment problems, Trump signed an order stating that the duty will take effect at 12.01 am EST from February 24, and will remain in force for 150 days, unless extended by Congress.

Why the global tariffs?

After the supreme court verdict, Trump announced the 10 per cent global tariffs. The administration argues that the United States is facing a large and serious balance-of-payments deficit, citing:

- A $1.2 trillion goods trade deficit in 2024, which remained at similar levels in 2025

- A current account deficit of 4% of GDP in 2024, the highest since 2008

- A negative balance on primary income for the first time since at least 1960

- A net international investment position at roughly –89% of GDP, described as one of the most negative among developed nations

According to the White House, the widening balance-of-payments deficit and growing reliance on imports pose significant risks to the US economy. Officials warned that persistent deficits could weaken investor confidence, increase dependence on foreign production for critical goods, and undermine both economic stability and national security.The administration argues that imposing temporary import restrictions will help stem the outflow of US dollars to overseas producers, encourage domestic manufacturing, and restore balance in the country’s trade position. Officials say the measure is intended to support American industries, strengthen economic resilience, and reduce structural imbalances in international payments.Read more: How much tariff will India pay after US SC ruling, Trump’s 10% global duty? What White House said

What exactly has been announced?

Under Section 122 authority, President Trump has:

- Imposed a 10% ad valorem import duty on most goods entering the US

- Limited the measure to 150 days, unless Congress extends it

- Classified the surcharge as a regular customs duty

- Directed modifications to the Harmonized Tariff Schedule of the United States (HTSUS)

- The surcharge will apply in addition to existing duties, except where Section 232 tariffs are already in place.

Which products are exempt?

The proclamation includes broad exemptions based on economic necessity and national interest.Key exemptions include:

- Certain critical minerals

- Metals used in currency and bullion

- Energy and energy products

- Fertilizers and natural resources unavailable domestically

- Certain agricultural products (including beef, tomatoes, oranges)

- Pharmaceuticals and ingredients

- Certain electronics

- Passenger vehicles and select auto parts

- Aerospace products

- Informational materials (such as books)

- Donations and accompanied baggage

- Trade agreement exemptions

- Goods compliant under: The

US-Mexico-Canada Agreement (USMCA); The Dominican Republic–Central America Free Trade Agreement (CAFTA-DR) - Products already subject to Section 232 tariffs are excluded from double application.

What is the legal basis?

The move is based on Section 122 of the Trade Act of 1974, which allows the US President to impose temporary import restrictions of up to 15% for a maximum of 150 days to address serious balance-of-payments problems. The administration has also used Section 604 of the same law to modify the country’s tariff schedule and implement the new duty.The action has been taken under broader presidential powers granted by Title 3 of the US Code. The White House said the measure is not aimed at protecting specific industries, but at addressing wider economic imbalances and stabilising the country’s international payments position.Also read: Why US Supreme Court struck down Donald Trump’s trade tariffs; explained in 10 points

What about de minimis shipments?

In a parallel executive order, the administration reaffirmed the suspension of duty-free de minimis treatment for low-value imports. Such shipments will also be subject to the new 10% surcharge.De minimis shipments are low-value international, business-to-consumer (B2C) packages allowed to enter a country duty-free and tax-free, with minimal customs procedures.

How does this fit into Trump’s broader trade policy?

The move signals continued reliance on tariffs as a structural tool in US trade policy.The administration stated that despite recent legal challenges to tariff authorities, it will continue reshaping trade relationships through a mix of tariffs and negotiated agreements.Officials argue that previous tariff actions have brought major trading partners “to the negotiating table,” covering more than half of global GDP.

What happens next?

The surcharge will remain in effect until July 24, 2026, unless:

- Congress extends the measure

- The President suspends or modifies it

- Economic conditions change significantly

The US Trade Representative has been directed to monitor developments and recommend further action if necessary.